- As we get into the weekend, Bitcoin is once again approaching $50,000, a resistance level beyond which it can’t seem to break, as expert opinion remains divided.

- One data wizard has told CNF that he expects a brief dip before Monday, but this will be quickly offset by the continued interest, especially from professional investors.

The weekend is here. And while this signals joy, relaxation, time with family and bliss all around, it’s a period of anxiety for Bitcoin traders. Weekends have been known historically to bring bad tidings, with the top cryptocurrency sometimes shedding up to 10 percent in two days.

Bitcoin is trading just above $49,000 and seems ready to once again test the $50,000 resistance level. One expert told CNF that he expects a brief dip over the weekend, but BTC will once again pick up the pace in the new week.

For the past two weeks, Bitcoin has been trading in a range between $45,000 and $51,000. Every time it has seemed to pick up momentum and ready to break past this range, it has been rejected at critical levels and retraced. On August 16, it was rejected at $48,000 and retraced to $44,000. It again picked up the pace and after testing $50,400, it was once again rejected and lost over $3,700.

BTC has once again picked up the pace and is approaching $50,000. In the past day, it has gained over $1,600, or 3.5 percent to trade at $49,050 at press time. It has set an intra-day high at $49,283, even as the trading volume has dropped slightly, expectedly so for a weekend.

A brief Bitcoin dip over the weekend

These price turns, especially the drops, are not unexpected. However, according to Yuri Mazur, the head of data analytics at CEX.IO Broker, a platform that offers cryptocurrency trading via CFDs, they can have a drastic effect.

Speaking to CNF, Mazur, who previously served for a decade as the head of portfolio at Ukraine’s Prominvest Bank, stated:

While the current reversal is not uncommon with sharp price runs, it can send a signal to weaker hands to sell off, and usher in an avalanche that might lead to a fall-off to the $40,000 price level.

However, despite this, Mazur pointed out that “Bitcoin’s fundamentals have never been stronger.” Citing a Chainalysis study, he observed that the number of whales (those with at least $50 million in BTC) has especially gone up.

“These accumulations contribute to reducing the overall scarcity of Bitcoin in supply as these whales are known to HODL for the long term,” he told CNF.

He added:

The current Bitcoin mining difficulty is also gradually returning to the levels it was before the China ban set in. With increasing difficulty, the attractiveness of mining reduces in theory, limiting interest and the number of coins generated. All these events are bound to have a direct impact on the price of the asset in the long term.

Weekends are known for price drops historically, and this may not be too different, the data wizard believes. However, even then, this may end up presenting an opportunity for the whales to continue the accumulation they began in July.

“If it happens, even a very massive price drop will be temporary as an imminent recovery will be ushered in the coming days,” he noted.

Shrinking Bollinger bandwidth signals trouble

There’s a lot that’s going for Bitcoin, from an astronomical 9x rise in adoption and skyrocketing wallet addresses to more countries such as Cuba acknowledging it.

Read More: The Republic of Cuba to officially recognize crypto and establish regulation

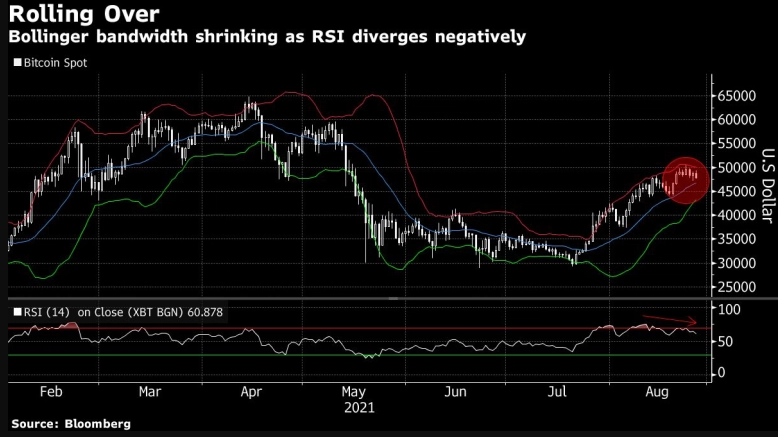

However, there are some red flags as well. One of these is mapped out by a popular technical indicator that looks at an asset’s volatility to predict future price movements – Bollinger bands. This statistical chart was put forward by John Bollinger in the 80s.

John took to Twitter this week to point out that Bitcoin’s Bollinger bands are narrowing (as can be seen in the chart below).

Time to pay attention: $BTCUSD Watch carefully, maybe take some profits or hedge a bit… Aggressive traders can think about putting out some shorts. Hodlers can look can look at add at lower levels if we see them. No confirmation yet, just be on the alert. #Bitcoin

— John Bollinger (@bbands) August 24, 2021

This indicates that Bitcoin is facing a resistance zone between $50,000 and $51,000. The defining level for the king of cryptocurrencies is in the middle line of the Bollinger bands, somewhere in the $46,000 level, and should BTC close for consecutive sessions below this, it will almost certainly drop to the $40,000 level, at least according to chartists.

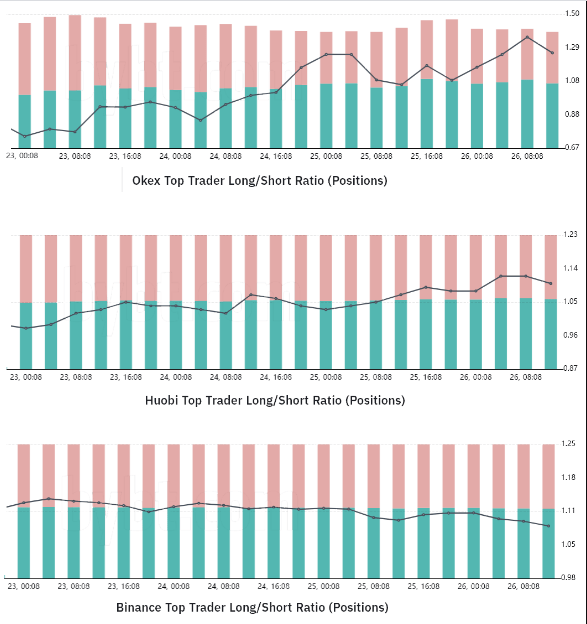

Elsewhere, top traders seem unfazed by such bearish outlooks and are increasingly longing BTC. Data from Bybt, a cryptocurrency derivatives data analytics platform, shows that most top traders from a number of the top exchanges are reducing their shorts and/or adding to their longs on BTC.

Top traders on OKEx and Huobi have all become increasingly bullish on BTC, with the long-to-short ratio on these exchanges rising in the past few days. On Binance, however, this metric has remained just bearish.

Recommended for you:

- Buy Bitcoin Guide

- Bitcoin Wallet Tutorial

- Check 24-hour Bitcoin Price

- More Bitcoin News

- What is Bitcoin?

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.