What is NEO – The Basics

NEO is a cryptocurrency that originated in China and was developed to create a scalable network for building distributed applications (dApps). The development team behind the NEO project has very similar goals to Ethereum. Because of the similarities, NEO is sometimes called the “Chinese Ethereum”.

But in contrast to the ETH blockchain, the NEO blockchain uses a two token model: the NEO coin and the GAS token. NEO is the underlying asset and generates GAS tokens which are used to pay the transaction fees in the network. If transactions take place on the NEO blockchain, then the transaction fees, e.g. for the execution of a Smart Contract or a decentralized application (dApp), are not paid in NEO but in GAS.

The NEO project was founded in February 2014 by Erik Zhang and Da Hongfei under the name “Antshares”. In June 2017 a rebranding into NEO took place.

In contrast to Ethereum, which has its own programming language with Solidity, NEO supports all common programming languages, such as Java, C++, Python and Javascript. The aim is to make it easier for developers worldwide to program applications on the NEO blockchain.

The aim of the NEO project is to become the “Blockchain Project No. 1” with the new NEO 3.0 in 2020.

NEO Development

- 2014: Foundation of Antshares

- 2015: Publication of the Whitepaper

- 2015: Launch of TestNet

- 2016: Release of the consensus mechanism dBFT

- 2016: MainNet Launch

- 2017: Rebranding of Antshares in NEO

- 2017: Development of the NEP-5 Token Standard

- 2017: Release of the first NEP-5 token by Red Pulse

- 2018: Start of decentralisation of the network

- 2018: Start of development for NEO 3.0

NEO governance mechanism

The governance model of NEO can be divided into “on-chain governance” and “off-chain governance”.

On-chain governance means that NEO owners can control and manage the network through voting. The GAS generated by NEO can be used to use the functions of the network and to transfer NEO tokens.

Off-chain governance is handled by the NEO Council. The NEO Council consists of the founding members of the NEO Project and is responsible for the promotion and development of the NEO ecosystem. Accordingly, the NEO Council makes strategic and technical decisions on how the NEO Blockchain is to be further developed.

Consensus mechanism: Delegated Byzantine Fault Tolerance (dBFT)

Instead of the common consensus mechanisms, the Proof of Work (e.g. Bitcoin, Ethereum, Monero) and the (Delegated) Proof of Stake (e.g. EOS, TRON), NEO uses a consensus mechanism called Delegated Byzantine Fault Tolerance (dBFT), which provides lower power costs and prevents hard forks.

The Delegated Byzantine Fault Tolerance (dBFT) is a consensus mechanism in which a certain number of consensus nodes are selected through a voting process. These nodes create and validate blocks together. NEO owners can actively participate in this process by selecting an accountant (“bookkeeper”) by voting, the consensus nodes. The selected group of consensus nodes reaches a consensus through the BFT algorithm and generates new blocks. The dBFT offers a single-block finality, which means that the NEO blockchain cannot be forced and transactions are irreversible. Once a transaction has been confirmed in the block chain, it can no longer be cancelled.

The coordination in the NEO network takes place in real time. In the NEO dBFT consensus mechanism, which takes place about 15 to 20 seconds to generate a block, a transaction throughput of up to 1,000 transactions per second (TPS) should be possible. According to the NEO development team, optimizations also have the potential to process block chains of up to 10,000 TPS.

The NEO Technologies

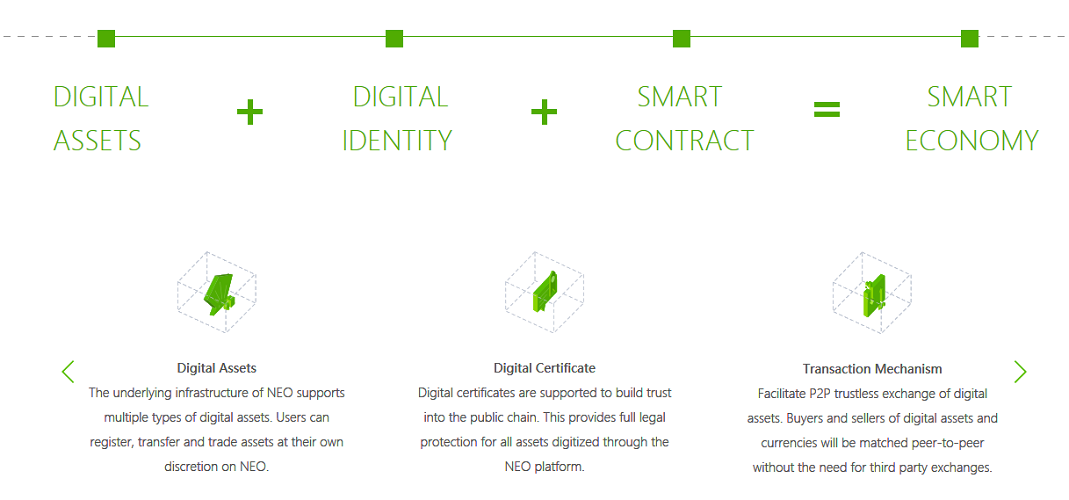

As mentioned earlier, NEO aims to create a scalable network for building distributed applications (dApps). The NEO blockchain thus creates the basis for a distributed network that combines digital assets, digital identities and smart contracts. NEO creates the possibility to digitize physical assets and to exchange peer-to-peer via the NEO network (“Smart Economy”)

The core technologies are the already mentioned dBFT, NeoContracts, NeoVM, NeoFS, NeoX and NeoQS.

NEO Smart Contracts

The NEO Smart Contracts, the so-called NeoContracts, are the core technology par excellence. Developers do not need to learn a new programming language, but can use C++, Java, and other popular programming languages in their familiar development environments (IDE) to develop smart contracts.

NeoVM

The NeoVM is a virtual machine whose architecture is very similar to the Java Virtual Machine (JVM) and .NET runtime environment. It works similar to a virtual CPU that processes Smart Contract instructions sequentially and performs process control based on the functionality of the instructions and logical operations.

NeoFS

NeoFS is a distributed storage protocol that uses Distributed Hash Table (DHT) technology. The technology indexes the data over the hash. This allows large files to be split into data blocks that are distributed and stored in many different nodes. This allows Smart Contracts to store larger files in the blockchain and to make access to these files efficiently.

In addition, NeoFS can be combined with NEO’s digital identity so that digital certificates can be assigned, sent and revoked without a central server for management.

NeoX

NeoX is a protocol designed to implement cross-blockchain interoperability to enable the exchange of digital assets across multiple blockchains.

NeoQS

NeoQS (Quantum Safe) is a cryptographic mechanism designed to prevent the NEO blockchain from becoming vulnerable to quantum computer attack.

The NEO Coin

With the Genesis block of the NEO network, 100 million NEOs were generated, which also represent the maximum supply of NEOs. Since there is no mining with dBFT, no further NEO Coins are generated.

However, there are currently only 70.5 million NEOs in circulation. This is due to the fact that originally only 50 million NEO were distributed to NEO supporters during crowdfunding. The second half of the total offering is managed by the NEO Council or has been integrated into Smart Contracts to support the long-term development, operation and maintenance of the NEO network.

The remaining NEOs will accordingly be released step by step by the NEO Council or the Smart Contracts. According to official information from NEO there are the following guidelines for this:

- 10 million NEO will be used to fund NEO developers and members of the NEO Council.

- 10 million NEO will be used to motivate developers in the NEO ecosystem.

- 15 million NEO will be used to promote other blockchain projects that are active in the NEO ecosystem.

- 15 million NEO will be retained as a hedge for possible liabilities.

- The annual issue of NEO must not exceed 15 million tokens.

Another special feature of the NEO coin is that the smallest unit of the NEO (currently) is always 1 NEO. A NEO is therefore not divisible.

Since the introduction of AntShares in June 2014, the price has risen sharply at times. From its initial price of USD 0.18, the NEO price reached an all-time high of USD 196.85 during the bull run at the end of 2017/beginning of 2018 and on 15 January 2018.

You can find the current NEO price on our overview (click here!).

The Gas Token

As explained in the basics, GAS is used to pay the network charges on the NEO blockchain. As with the NEO Coin, the total range of GAS tokens is 100 million. However, the GAS were not generated by the Genesis block, but are generated by an algorithm in about 22 years only gradually completely.

The release is made with each new block proportional to the ownership of NEO Coins. NEO-owners have the possibility to “claim” via their Wallet GAS. Selected exchanges such as Binance automatically credit GAS to your account. However, there is no claim at exchanges that these will credit GAS to your account.

Interesting to know is also that the release is not linear. Instead, NEO uses an algorithm that follows a release curve. In the first year, 16% of GAS tokens, 52% of GAS in the first four years and 80% of GAS in the first 12 years are generated. Thus the release decreases continuously until sometime (in total 22 years) all GAS tokens are generated.

NEP-5 token Standard

The NEP-5 NEO token standard is a technical standard similar to the ERC20 standard at Ethereum to develop smart contracts on the NEO blockchain. The term is composed as follows:

- NEP stands for “NEO Enhancement Proposal”.

- the number “5” stands for the version of the protocol agreed upon by the developers.

The NEP-5 standard thus offers developers a standardized workflow and a template for building decentralized applications. This template is very handy for developers because they have less time to spend on token creation and can program functions of the token instead.

Strictly speaking, every NEP-5 token is a smart contract, but works like a token which you can send, receive and store like any other cryptocurrency. Since all NEP-5 tokens are based on the NEO blockchain, they can also be automatically exchanged with any other token that uses the NEP-5 standard (“cross-token communication”).

NEO 3.0: A new beginning with Token Swap

In April 2019 NEO presented the roadmap for NEO 3.0. NEO 3.0 is intended to fundamentally improve the NEO blockchain and introduce major changes. NEO 3.0 pursues the following objectives:

- higher throughput

- increased stability

- better security

- an optimized Smart Contract system

- a more functional infrastructure

This is to be achieved through the following measures:

- Among other things, a dBFT 2.0 will be implemented, adding a recovery mechanism to NEO to ensure faster recovery in the event of a network or node failure.

- Furthermore, a new pricing model is to be implemented, as relatively high costs are currently incurred for the provision and operation of smart contracts. According to the NEO Council, this hinders the development of the NEO ecosystem. In NEO 3.0, the provision and transaction costs of Smart Contracts are therefore to be significantly reduced.

- In addition (similar to Aeternity) oracles are to be integrated. This enables Smart Contracts to access external resources during execution, for example to retrieve data from third-party software. The oracles should enable developers to develop new and more complex dApps based on external data.

- The P2P protocol is to be redesigned to add support for the UDP communication protocol and enable compression options. This should significantly increase the number of transactions per second (TPS).

- The NeoVM is to be completely decoupled from the blockchain in order to facilitate the implementation of Smart Contracts.

For NEO owners the biggest because most obvious change will be, however, that it will allow NEO 3.0 to divide NEO Coins into smaller units. The currently (as of June 2019) indivisible NEOs such as Ethereum or Bitcoin are to be divisible into units smaller than 1 in the future.

The development of NEO 3.0 began in the fourth quarter of 2018 and is expected to be completed in the second quarter of 2020. Due to the serious changes, NEO 3.0 will then be launched as a new blockchain network from a Genesis block. For NEO owners this will mean that the existing NEO Coins will have to be replaced by “new” NEO Coins.

Bottom line: Is NEO worth an investment?

NEO is, along with EOS and TRON, one of Ethereum’s strongest challengers to rank the best and most successful dApp platform. Compared to Ethereum, NEO allows developers to use (almost) any common programming language instead of learning a new one.

On the other hand, NEO can only be classified as a direct competitor of Ethereum to a limited extent. The clear focus of the project is on the Chinese market. Due to its Chinese origin, NEO already has great support in China. Since the Chinese market is huge. Accordingly, the potential is also very large. China has a long tradition of favouring local technology companies over foreign ones. For the blockchain crypto space, China could pursue this approach further and prefer Chinese blockchain start-ups such as NEO and Onchain (the B2B company from the NEO founders).

There have been many rumours in the past that NEO and Onchain are being tested by the Chinese government. If the promising Onchain technology and NEO will one day be integrated by Chinese companies, this could mean a broad acceptance of NEO in China, which should drive up the NEO price significantly.

At the same time, however, the Chinese origin also carries a great risk, as China has issued particularly strict regulations in the past in connection with cryptocurrencies and as a broad acceptance of NEO is by no means guaranteed.

If you are still interested in investing in NEO, we recommend our guide on how to buy NEO (click here!).

Further information: The NEO Whitepaper

[ratings]Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.